|

Acomplys SaaS Blisteringly Fast Search & Compliance Aptelisense Acomplys enables organizations to securely share and search data in the cloud. Acomplys uses in-memory real-time data techniques that provide millisecond search times across millions of records. The New Zealand Insurance Claims Register (ICR) has recently moved to Acomplys and the service now holds around 90% of the fire and general claims lodged with the major insurance companies in New Zealand. ICR manager Dave Ashton commented: “The ICR platform provided by Acomplys has transformed our ability to detect insurance Fraud and introduce geospatial analysis and real time alerting”The ICR Acomplys service also enables insurance companies to automate claim checks using Compliance Automation Server and integrate the results with their existing applications to provide benefits such as:

|

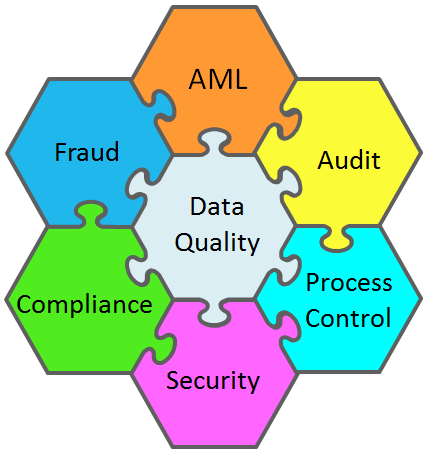

360° Data Compliance Unified Risk Coverage

Protect your data from the risks you know and the ones you don't. Ensure the quality of your small data for big data benefits. Continually validate your data and transactions and ensure that your customer data is clean across all your data sources. Compliance Automation Server enables you to control risk across your data and prevent fraud. With just one product you can bridge all the areas of risk without needing to change your systems or applications. |

Compliance Automation Server Focus On Insurance Claims CAS enables insurance organizations to automate monitoring and protection against leading edge fraud and leakage such as:

Use CAS to automate your policy across insurance claims and free up your analysts to focus on the important events.

CAS is easily integrated with products such as IBM i2 and Case Management solutions. Download our

general insurance datasheet

|

|

Acomplys SaaS Blisteringly Fast Search & Compliance Aptelisense Acomplys enables organizations to securely share and search data in the cloud. Acomplys uses in-memory real-time data techniques that provide millisecond search times across millions of records. The New Zealand Insurance Claims Register (ICR) has recently moved to Acomplys and the service now holds around 90% of the fire and general claims lodged with the major insurance companies in New Zealand. ICR manager Dave Ashton commented: “The ICR platform provided by Acomplys has transformed our ability to detect insurance Fraud and introduce geospatial analysis and real time alerting”The ICR Acomplys service also enables insurance companies to automate claim checks using Compliance Automation Server and integrate the results with their existing applications to provide benefits such as:

360° Data Compliance Unified Data Compliance

Protect your data from the risks you know and the ones you don't. Ensure the quality of your small data for big data benefits. Continually validate your data and transactions and ensure that your customer data is clean across all your data sources. Compliance Automation Server enables you to control risk across your data and prevent fraud. With just one product you can bridge all the areas of risk without needing to change your systems or applications. Learn more how CAS can protect your data Compliance Automation Server Focus On Insurance Claims CAS enables insurance organizations to automate monitoring and protection against leading edge fraud and leakage such as:

Use CAS to automate your policy across insurance claims and free up your analysts to focus on the important events.

CAS is easily integrated with products such as IBM i2 and Case Management solutions. Download our

general insurance datasheet

|